What Is The Opportunity Zone In The US?

Opportunity Zones are a federal economic development tool created under the 2017 Tax Cuts and Jobs Act. They are designed to improve and boost economic growth in communities across the United States. Along with the economic growth, this will also allow the communities to find new job opportunities in that area.

Why Did The Opportunity Zone Come Into Existence?

Opportunity zones came into existence when the states were battling with the Great Recession and to rescue people from this situation it was proposed to create opportunity zones across the states. The primary goal was to attract investors and retain them for the long term so that the communities could benefit from it.

So, the Opportunity Zone bill was introduced in the year 2016 and was reintroduced again in 2017. The enactment took place in 2017 as a part of the Tax Cuts and Jobs Act and several regions were nominated under this policy.

Credits – https://www.armanino.com/articles/opportunity-zones/

How Many Opportunity Zones Are There In The US?

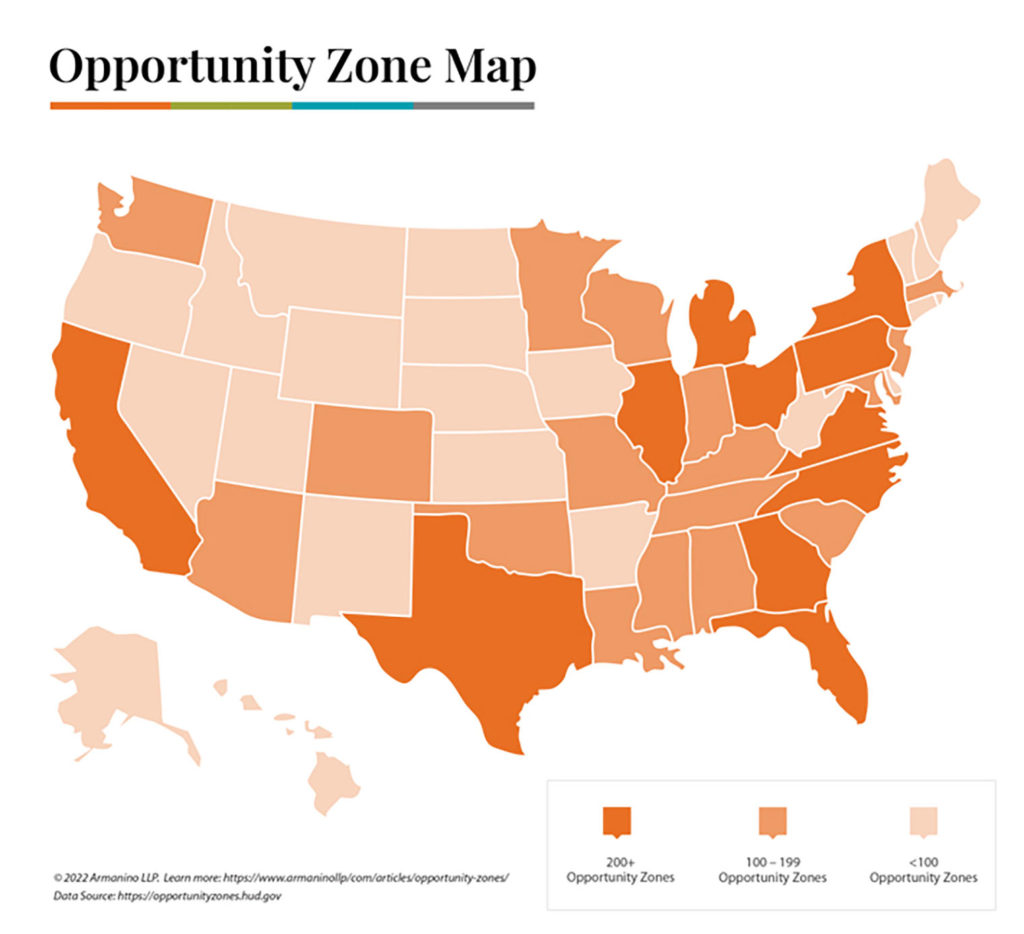

Well, there are several zones that are marked across the United States. These zones are designated by the low-income census tracts where tax incentives are available to groups or individuals who invest in an Opportunity Fund, which is an investment vehicle for injecting money into an Opportunity Zone. There are over 8,700 Opportunity Zones, representing 12 percent of all census tracts, with nearly a quarter in rural areas.

In this list, California, Texas, New York, Florida, and Illinois top the list to buy property in the opportunity zone.

For example – Places like Texas have a lot of new opportunities for the investors. They are not just the regular ones like you would find in other cities. In Texas, you can buy land and homes in opportunity zones which are near lake as well. Homes have options for spec homes as well as custom homes.

How To Invest in An Opportunity Zone?

- Identify Capital Gains for Investment: The first step is to identify your capital gains that you wish to invest

- Invest in a Qualified Opportunity Fund (QOF): Investments in Opportunity Zones must be made through a QOF. A QOF can be a partnership or C corporation that certifies it is a QOF. The primary way individual investors can invest in Opportunity Zones is through Opportunity Zone funds. These funds are primarily managed by large investment funds that invite affluent individual investors to join

- Choose the Type of Investment: The investment fund chooses the investments that it believes will provide the greatest return for the investors. These investments can include physical assets and ownership stakes in local businesses

- Invest within the Required Time Frame: Once they sell an asset for a gain, they have 180 days to invest the money into a Qualified Opportunity Fund

- Another way to invest in Opportunity Zones is through an Opportunity Zone REIT. A REIT—or real estate investment trust —is a company that owns and operates real estate investments.

Before investing, it’s important to understand the tax benefits and potential risks associated with investing in Opportunity Zones. Always consult with a financial advisor or tax professional to understand the implications for your specific situation.

What Are The Perks Of Buying Property In The Opportunity Zone?

Without perks, no investor is going to keep their hard-earned money on the table. So investors, why should you buy homes in the opportunity zone?

- The program is meant to spur investment in undercapitalized communities and provides three tax benefits for investing unrealized capital gains in Opportunity Zones

- Investors stand to gain a temporary deferral on their capital gains taxes if they hold their investments for at least 5 years, and a permanent exclusion from a tax on capital gains from the Opportunity Zones investments if the investments are held for 10 years

What Is The Current Trend Of The Opportunity Zone?

Economic data indicates $6.1 trillion in unrealized capital in Opportunity Zones. In the first financial quarter of 2022, Qualified Opportunity Fund equity grew at a 16.3% faster rate than in the previous quarter. The U.S. Executive Office Council of Economic Advisers (EOCEA) concluded in their initial impact report of 2020 that the OZ program has the potential to “lift 1 million people out of poverty and into self-sufficiency, decreasing poverty in OZs by 11 percent.”1 OZ designation alone increases housing values in the area by 1.1%. OZ homeowners stand to gain a cumulative $11 billion in wealth

Hence, if you are planning to buy property in the US you can check for the opportunity zones which will be comparatively less pricey than other locations. Moreover, you would actually save a lot on your property investment.

References –

https://www.forbes.com/sites/sorensonimpact/2023/05/22/exploring-opportunity-zones-exciting-new-data-on-the-positive-impact-of-ozs-across-the-nation/?sh=14ae3c8a68f0

https://www.investopedia.com/opportunity-zone-5207933

https://www.opportunityzones.help/

https://ipropertymanagement.com/research/opportunity-zone-statistics